4 Key Trends in Banking to Watch for The Best Customer Service

We’re all sick of hearing about how the Covid-19 pandemic has changed the way we work. And trust me, I’m a little tired of writing about it, too. But, the facts remain: business operations will never return to a pre-2020 world. But, at least in terms of customer service, maybe that’s okay.

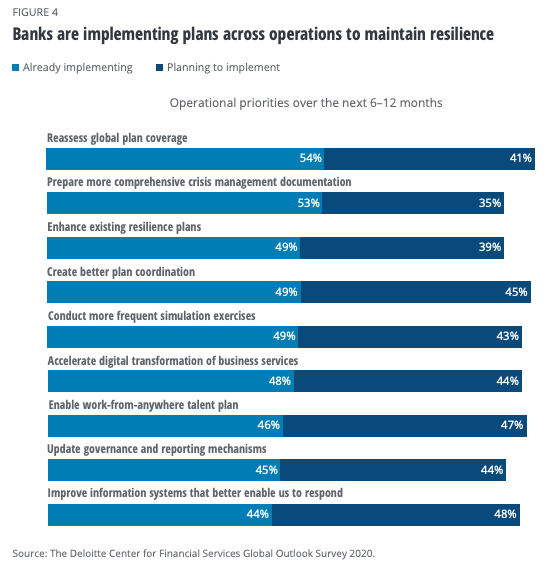

For instance, in the banking industry, the pandemic uncovered significant shortcomings in digital capabilities. In response, 95% of senior banking and capital markets executives surveyed by Deloitte said their institutions are or are planning to accelerate digital transformation of services over the next 6-12 months to maintain operational resilience.

Moving forward, we’ll see changes in just about every dimension of banking. From how they engage with customers to how they’re coaching, training and empowering their talent. And then, shifts to their technology platforms and physical (and digital) infrastructure.

Here are four trends we saw the pandemic bring that are poised to become industry mainstays:

1. Digital transformation is more strategic in the best customer service teams

While the financial sector was able to weather the digital tsunami the pandemic poured down, it’s become clear the winds of change aren’t transient. Banks now must think strategically about their technical setup, figuring out whether the tools they have now are the ones they’ll continue to rely on.

Legacy, first-gen core systems and customer engagement tools that many banks are still using weren’t designed with our digital age in mind. We need agility and flexibility to innovate and ways to shift to support the (ever-changing) regulatory requirements and demands for data protections and privacy.

Moving forward, banks, along with pretty much every other industry in the world, will move to next-gen platforms that’ll get them past outdated limitations, according to Deloitte. These platforms, they said, have a modular, nimble design that uses a plug-and-play architecture with open API-driven and microservices-based interoperability layer. And, they added, they’re being built natively in the cloud, which gives you – whether you work for a bank or are a customer of one, accessibility to all kinds of channels.

2. Customers are even pickier with their standards of service excellence

Modern technology and instant communication platforms on social and retail platforms have conditioned your customers to expect instantaneous results. In fact, my internet went down for two whole minutes while writing this post (gasp!) and my anxiety peaked. People – you, me, your customers – have completely lost the ability to wait. Tweets, Instagram, and texting require no patience and they provide users with immediate gratification. And, people have come to expect the same from their financial institutions.

It’s no longer enough to give your customers amazing service and competitive rates. Now, they want all that proactively.

Until recently, customers have interacted with their banks mostly through transactions they initiated. Maybe for a new car or house purchase or perhaps for service on an existing account. Sure, they’d get the occasional account-related notification or a marketing campaign message. But overall touchpoints between a bank and its customers were usually transactionally focused and low in frequency and engagement.

Now, though, digital apps have spurred an always-on engagement model, curated with real-time content available for your customers when and where they want. And, from the call center agents and banker’s end, rich customer data available through omnichannel customer experience platforms (*cough* I might know of a good one *cough*) can lead to broader, more meaningful conversations with every customer.

[See Next] The Omnichannel Contact Center Platform

3. Align your customer service to…the customer

Deliver an experience that your customers want to be a part of. Delight them so hard that they go home and brag to their friends and family about the best customer service you showed them. Or (better yet) they share a braggy post on Instagram immediately.

Part of aligning the experience means to meet them where they are. Give them a plethora of channels to interact with you on. When they want. How they want. Then, give them a way to change their minds, mid-interaction.

So how, you might ask, do you align your member experience strategy to actually delight your members?

Answer: Omnichannel.

“Omnichannel” is one of those words (like “personalization” and “big data”) that’s earned a spot on the CX buzzword Bingo card. It’s overused and (often) abused.

But at the heart of every great customer experience is an interaction that’s easy to navigate and execute, for both the customer and your agents. It’s time to slow down and think through all the ways your customers are reaching out to you. And make sure you have your foundational bases covered.

The pandemic turbocharged the digital adoption of channels like websites, mobile apps and video banking, among others. In fact, according to J.D. Power’s Financial Services COVID-19 Pulse Survey, 44% of retail banking customers said they’re using their primary bank’s mobile app more often now. And, there’s a similar pattern in commercial banking, too. Bank of America’s business banking app saw 177% growth in mobile check deposits in Q3 2020 alone.

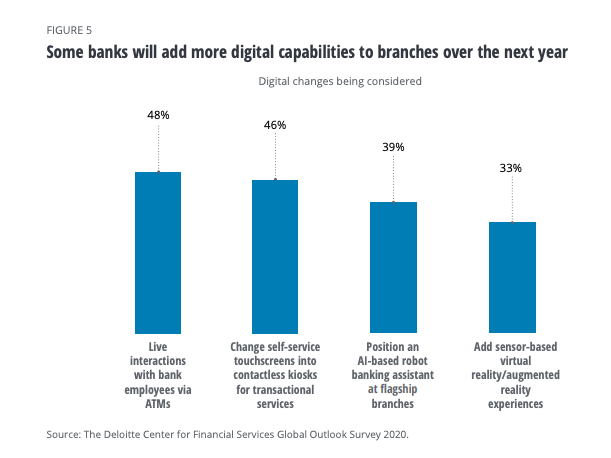

But, that doesn’t mean customers will skip out on traditional physical channels for good. In fact, those who use mobile and computing channels at least twice a week are +60% more likely to be active branch users. That means, while interested in new technologies, customers still value face-to-face interactions.

According to Deloitte, nearly 50% of senior banking and capital markets executives say their institutions are considering live interactions with bank staff via ATMs, and installing self-service, contact-less touchscreens. Pre-pandemic, we saw one of our financial institutions turn to a centralized banking model where they installed video kiosks at branch locations. Those kiosks let their tellers and other customer-facing folks give real-time, face-to-face interactions to customers while cutting FTE costs by about a million annually.

4. Security and compliance still reigns all

Financial service pros are investing billions in security and compliance. And that’s not looking to slow down over the next year.

While overall, the financial sector is one of the most improved when it comes to security maturity, it still sits at an incredible risk, second only to the healthcare industry. Data from Varonis found the average cost of a financial services data breach is $5.85 million. And, the longer your incident response takes, the higher the cost of the data breach is likely to be.

Financial services companies get attacked over a billion times each year, according to ForgeRock. That breaks down to about 30 attacks every second.

The hard truth to swallow is, though, that not all of these breaches are the result of some schemey faceless person. IBM and the Ponemon Institute estimate that 50% of incidents are the result of malicious or criminal attacks. Some 27% of breaches stemmed from system glitches, while 23% were the result of negligent employees.

Threats to your security and compliance exist both outside of your walls and in. Negligence is as real of a threat as a faceless hacker.

Moving forward, as you invest in more (and better) cloud technology, make sure your team is up-to-date on adoption. Spend time to coach and train your employees so they understand how to use the platforms securely. And, above all, enable your team to provide the very best customer service – safely.